vermont income tax withholding

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. Determining income tax for civil union members.

Vermont Payroll Tools Tax Rates And Resources Paycheckcity

Since a composite return is a combination of various.

. When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding. Exemption Allowance 4500 x. Pay Period 03 2019.

An employee in a civil union. Vermont income tax of a civil union partner is computed in the same manner as if the partners were married. March 8 2019 Effective.

You must pay estimated income tax if you are self employed or do not pay. Before 2018 it was unclear how federal income tax withholding and reporting for IRA assets that are paid to the states should. New York City.

The income tax withholding formula on. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United. I am a W-2 consultant who lives in New Jersey but is currently working in New York City.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Withholding and Reporting for Escheated IRAs. October 4 2022 The Office of the United States Attorney for the District of Vermont stated that today Jerry Banks of Fort Garland Colorado was charged with a murder.

The employment agency originally withheld federal and New York taxes from my paycheck. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. TAXES 19-23 Vermont State Income Tax Withholding.

Vermont Income Tax Vt State Tax Calculator Community Tax

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vt Dept Of Taxes Vtdepttaxes Twitter

State Withholding Tax Table Maintenance Vermont W Hx03

Form In 111 Vermont Income Tax Return

Vermont Tax Information Town Of Craftsbury

Big Changes For The New W 4 Form Cpa Practice Advisor

Vermont Tax Information Town Of Craftsbury

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

What Is State Income Tax Charts Maps Beyond

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Federal State Payroll Tax Rates For Employers

Form In 111 Vermont Income Tax Return

Vt Dept Of Taxes Vtdepttaxes Twitter

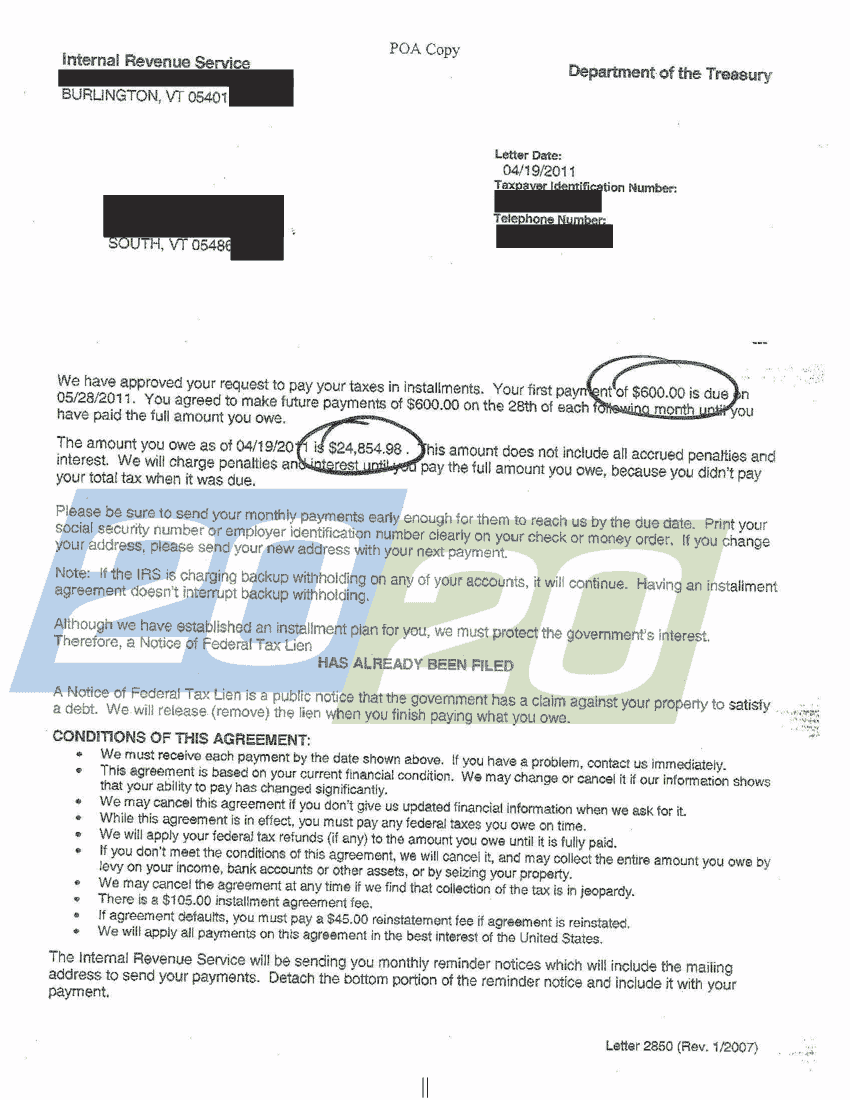

Successful Tax Resolutions In Vermont 20 20 Tax Resolution